#Free cash flow formula from ebitda for free#

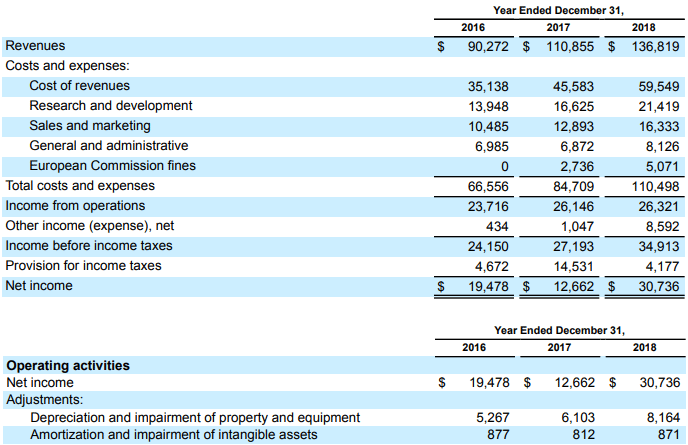

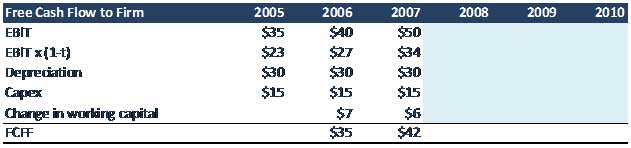

Start for Free by clicking here.Unlevered Free Cash Flow, also known as UFCF or Free Cash Flow to Firm (FCFF), is a measure of a company’s cash flow that includes only items that are: If you are looking for a quick and reliable way to test the value of a company - you are welcome to use Equitest - an AI Business Valuation Software. Which is more common in business valuation, you ask? The answer is - Definition 1. In the previous section, we presented the two standard definitions of the FCFF. The investment in working capital equals the increase of working capital in a specific year relative to the previous year.ĮBIT vs EBITDA - Which is More Common for the DCF Model? These are investments in the firm's fixed assets, that is, in assets that help generate the firm's income. Where: EBIT=Earnings before interest and taxes Amortization is an accounting technique used to periodically lower the book value of a loan or an intangible asset over a set period.ĭepreciation and amortization are added because they are non-cash deductions, and whoever buys your business will have their depreciation and amortization schedules.įree Cash Flows to the firm (FCFF) denotes the amount of cash flow from operations available for distribution after accounting for depreciation expenses, taxes, working capital, and investments.

The amount depreciated is called Depreciation. Depreciation is the process of deducting the cost of a business asset over a long period rather than over one year. Depreciation - how much of an asset's value has been used.Taxes – the amount of the firm's income paid to the government.ĮBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization.ĮBITDA = EBIT + Depreciation + Amortization.Adding back a business’s interest expense allows the new owner to choose if they’ll use debt to buy the company and negotiate their terms. Interest – Since any business with debts to pay will have some interest expense.It's the bottom line of the profit and loss statement.

This article will discuss two accounting terms used to build the FCFF - EBIT and EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). the weighted average cost of capital (WACC). Evaluating companies using the DCF (Discounted Cash Flow) method requires capitalizing the Free Cash Flows to the firm (FCFF) at the appropriate discount rate.

0 kommentar(er)

0 kommentar(er)